Automated Trading, Simplified.

Institutional-grade, multi-strategy systems for crypto. Run it yourself with free VIP signals or switch on full automation in minutes.

Our Services

Two systems. One goal:

Scale your Portfolio

We design, develop, and implement automation tools that help you work smarter, not harder

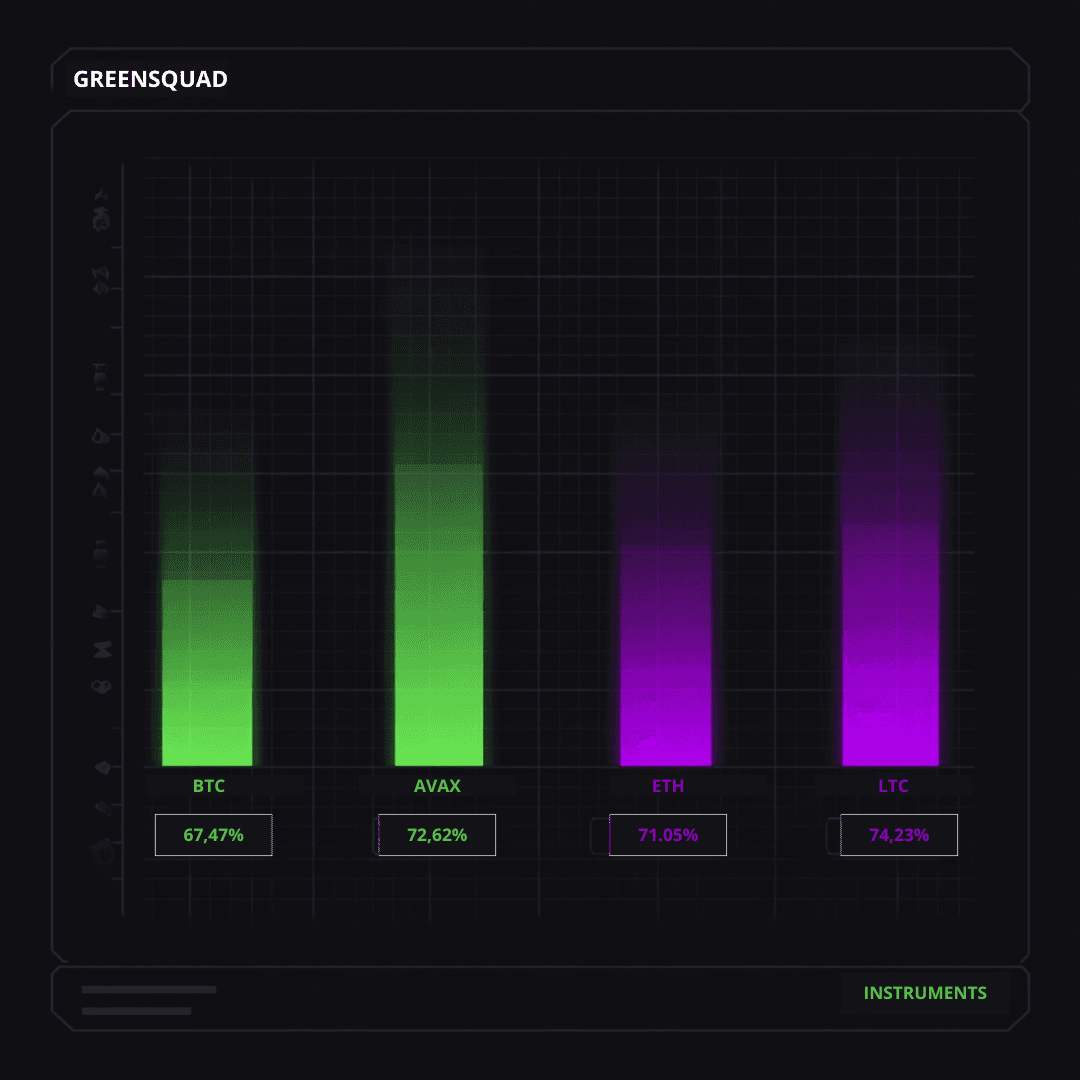

BTC/ETH/AVAX/LTC

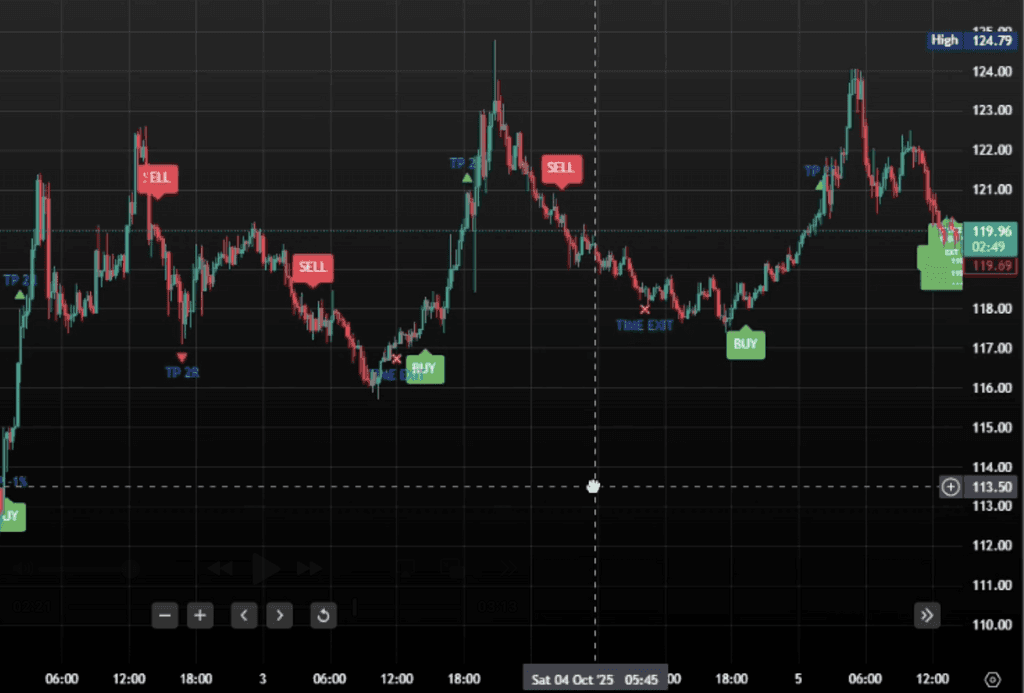

ScalperBot (15m)

A short-term momentum system built for high-frequency execution. It runs with a fixed 1% stop-loss and multi-level take-profit logic to lock in moves as they develop, making it a disciplined choice for active traders who want fast entries, fast exits, and consistent rules.

15m Timeframe

Multi-TP Logic

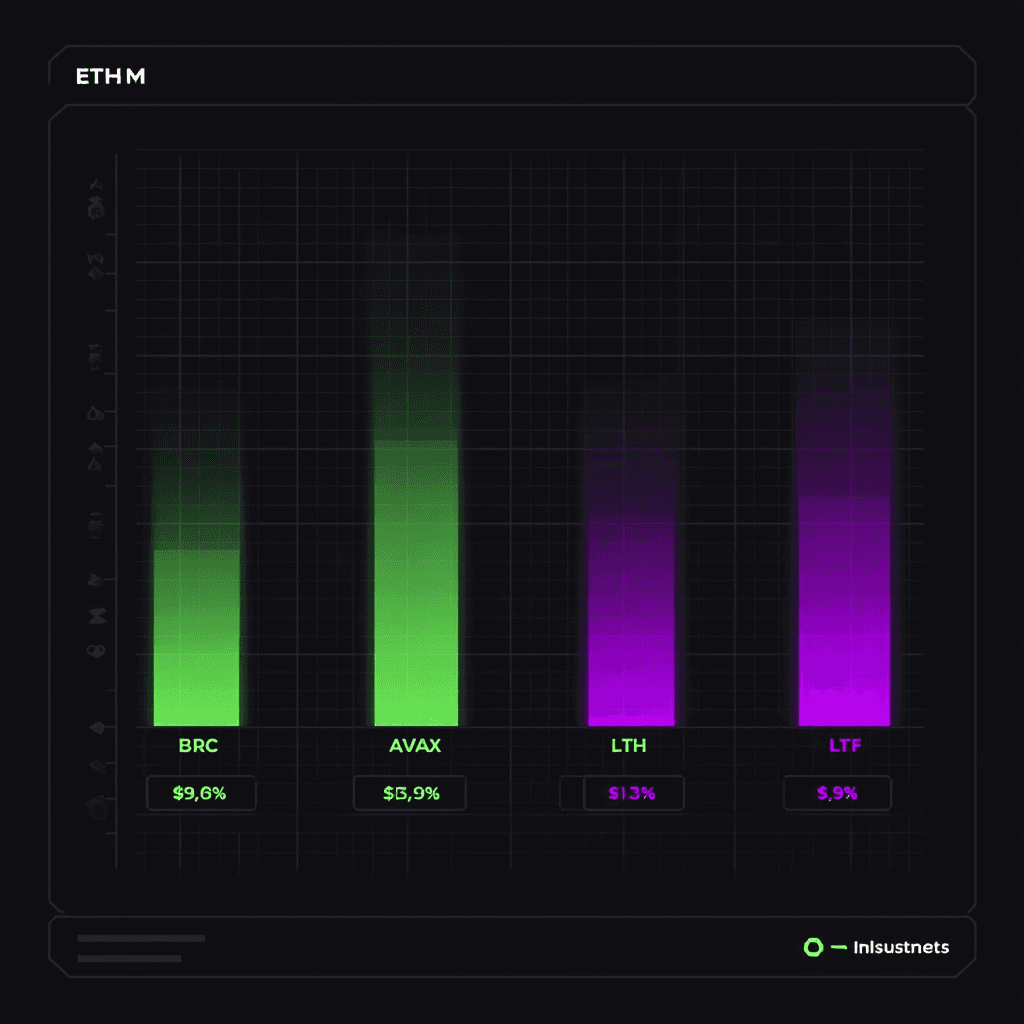

BTC/ETH

SniperBot (1D/1W)

A swing-focused system that targets entries around key accumulation zones. It aligns with overall trend and market structure, trades less often but aims for higher risk-to-reward outcomes, and suits investors or position traders who prefer measured, higher-conviction setups.

1D / 1W Swing

Higher R:R

Accumulation Zones

Accumulation/Wyckoff

Add document

Analyze

Generate Image

research

Workflow

HOW IT WORKS

From zero to automation in minutes

Step 1

Connect Exchange

Secure API with Bybit or supported exchanges.

Step 2

Pick Your System

ScalperBot, SniperBot, or both.

Step 3

Start Trading

We handle execution; you monitor the results.

Case Studies

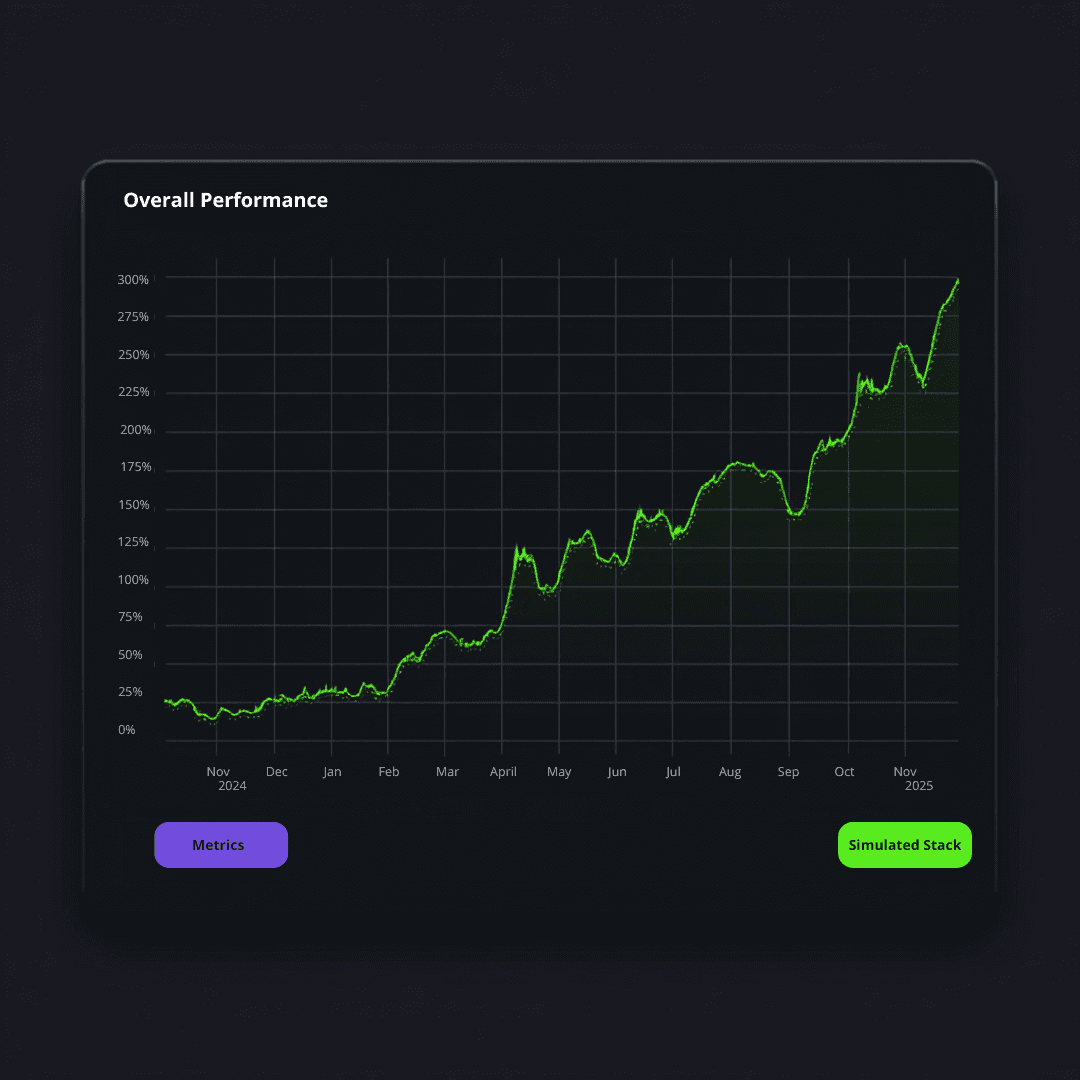

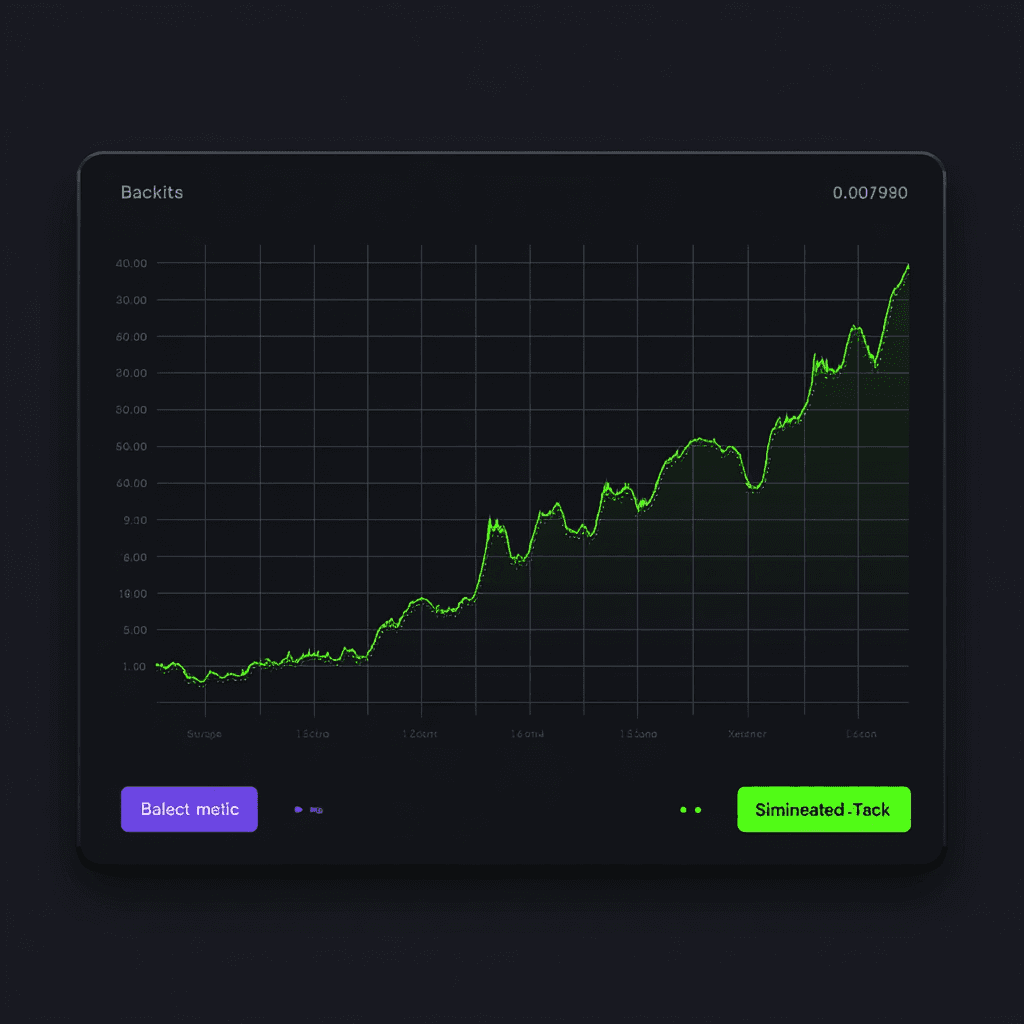

PERFORMANCE

Realistic, rules-driven performance

Pricing

The Best AI Automation, at the Right Price

Choose a plan that fits your business needs and start automating with AI

Testimonials

Why Traders Love us

FAQs

We’ve Got the Answers You’re Looking For

Quick answers to your AI automation questions.

Let's get Started with Automated Trading!

Book a Call Today and Start Automating